Aggressive incentives for EV companies to maximize return on investment.

South Carolina’s performance-based tax incentives reward

companies for job creation and investment.

South Carolina offers the following statutory tax incentives:

- No state property tax

- No inventory tax

- No sales tax on manufacturing machinery, industrial power or materials for finished products

- No wholesale tax

- No unitary tax on worldwide profits

- Favorable corporate income tax structure

- No local income tax

2.5%

income tax credit for company investment to manufacturers locating or expanding in SC

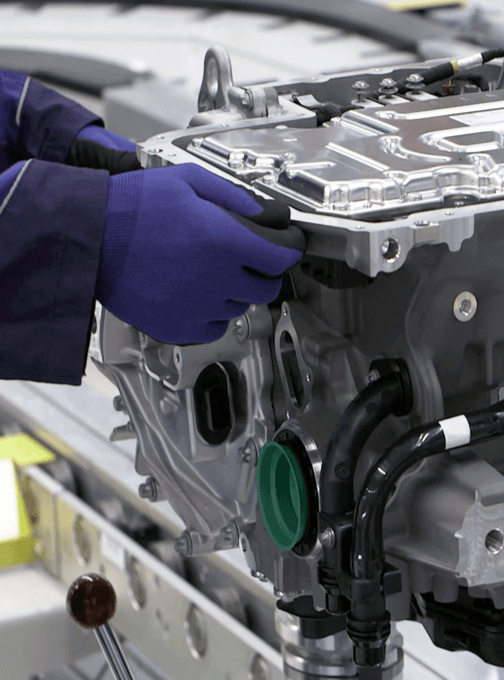

SC’s commitment to electric vehicles

is demonstrated by the following:

Corporate taxes

Several ways to potentially eliminate your entire corporate income taxes.

Sales taxes

A range of sales tax exemptions that reduce start-up and operating costs.

Property taxes

Property tax incentives that can be tailored to meet your company’s needs.

State discretionary incentives

Special state discretionary incentives may be used to meet specific needs.

Workforce training

Providing the training and education necessary to fill the most in-demand jobs for business growth.

Business Incentives

South Carolina supports the production of electric cars for both new and expanding business with exemptions to the state and local sales tax, including machinery used in the production of tangible goods.